Irish Credit Union Customers Facing Loan Restrictions [Article & Infographic]

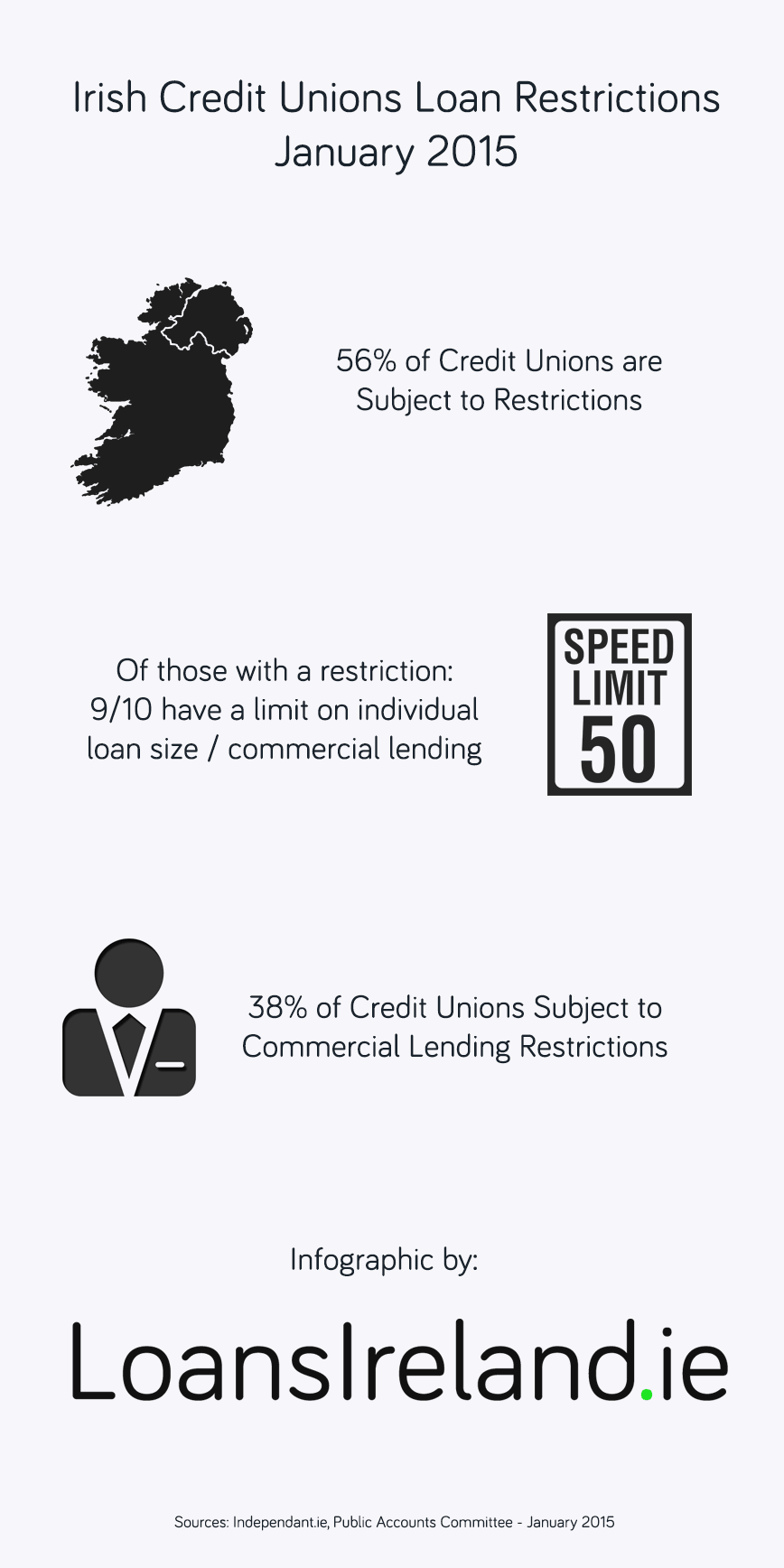

More than fifty percent of Ireland’s credit unions are currently subject to loan restrictions.

In many cases this means that credit unions are restricted to providing loans for amounts between €10,000 and €30,000.

The regulator stated that the majority of loans provided were now lower than than what is allowable under the current restrictions.

In a briefing to the Public Account Committee Deputy Registrar of Credit Unions Elaine Byrne stated that 56% of Ireland’s credit unions were subject to loan restrictions.

Of the credit unions with restrictions:

- 9/10 has a limit on individual loan size / commercial lending

- Less than 10% have an aggregrate monthly loan amount restriction

Of all credit unions (not just those with restrictions):

- 38% subject to commercial lending restrictions

We have put together an infographic with some of the main statistics.

Source: LoansIreland.ie

“In general, we view this type of lending as high risk and not appropriate for the majority of credit unions, particularly in light of the current issues that have been identified in relation to lending standards and practices.”

According to the regulator the restrictions were not set in stone, and were being reviewed on a frequent basis.

The Irish League of Credit Unions described the restrictions as ‘unduly broad’.

Main image: Credit Union by Simon Cunningham

Loans

![Irish Credit Union Customers Facing Loan Restrictions [Article & Infographic] Irish Credit Union Customers Facing Loan Restrictions [Article & Infographic]](https://loansireland.ie/wp-content/uploads/2015/01/credit-union-scrabble-868x600.jpg)